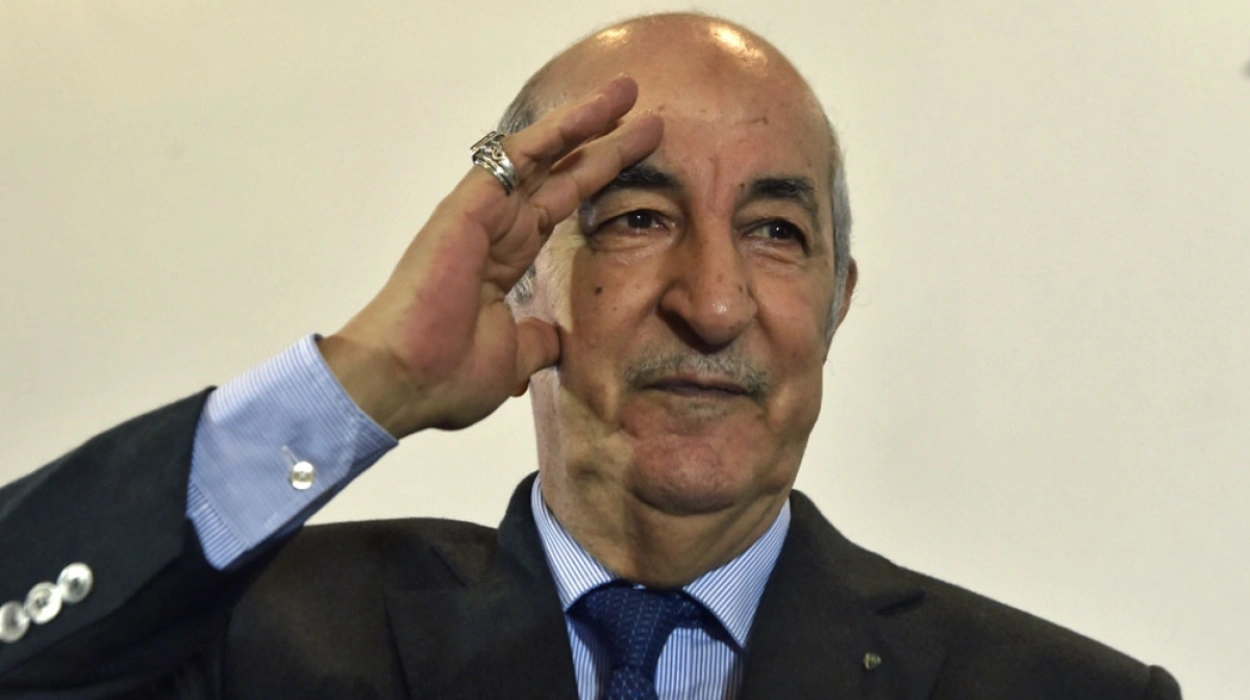

President Abdelmadjid Tebboune’s entourage in Algeria represents a significant segment of elite individuals implicated in laundering illicit wealth through Dubai’s sprawling luxury real estate market. Investigations reveal that close associates and influential businessmen connected to Tebboune’s administration hold nearly 1,000 properties across Dubai, valued at over $620 million. These extensive holdings primarily comprise luxury apartments and villas in areas such as Burj Khalifa, Palm Jumeirah, and Downtown Dubai, hotspots favored for their prominence and relatively lax transparency in ownership disclosure.

Read Our Full Report:

Report: Dubai Real Estate Laundering Exposed: Mapping the Flow of Dirty Money (2024–2025)

Political and Economic Influence Behind Wealth Accumulation

Members of Tebboune’s entourage have accumulated wealth through government contracts, monopolies particularly in oil and gas, and telecommunications sectors. Alleged embezzlement and kickbacks have funneled state resources into private coffers, which are subsequently invested in Dubai’s real estate as a safe haven. This aligns with a broader pattern of political elites from the previous Bouteflika regime transitioning their wealth offshore, maintaining power and financial security through opaque channels.

Read Our Full Report:

Exploiting Offshore Shell Companies to Obscure Ownership

The entourage’s real estate acquisitions heavily rely on offshore shell companies registered in secrecy jurisdictions. These companies serve to veil beneficial ownership, enabling actors to purchase high-value properties without revealing their identities. Such corporate structures, combined with nominee directors, create layers of complexity that severely hinder regulatory scrutiny, perpetuating illicit finance flows under Dubai’s favorable yet opaque legal framework.

Cash Transactions and Private Management Companies

Reportedly, large cash payments and the use of private real estate management firms are routine among these elites. This approach masks the financial origins and enables rental income and capital gains to circulate seemingly legitimately. Nominee management and private firms provide further anonymity, complicating law enforcement’s ability to trace illicit proceeds embedded within luxury real estate assets.

Off-Plan Property Schemes as a Laundering Tool

Off-plan properties, often purchased during Dubai’s construction booms, offer fresh opportunities to launder money. These investments enable staggered payments and flexible ownership transfers before formal registration, allowing illicit funds to be layered and legitimized. Such schemes are prevalent among Tebboune’s close associates, exploiting Dubai’s regulatory gaps to further embed corrupt wealth in the real estate sector.

UAE Anti-Money Laundering Reforms: Progress and Limitations

Although the UAE has introduced reforms to enhance AML compliance and beneficial ownership transparency, enforcement challenges persist. The entrenched practices within Tebboune’s network underscore the difficulty in uprooting illicit finance amid complex corporate disguises and a historical tolerance for opacity in Dubai’s property market. International cooperation and targeted sanctions remain essential to break these laundering chains.

| Individual/Company Name | Location | Estimated Value (USD) | Ownership Structure |

|---|---|---|---|

| Fredrick Okumu | Downtown Dubai, Al Barari | $12-18 million | Offshore shell companies, nominee directors |

| Amara Charaf-Eddine | Burj Khalifa, Dubai | $4-6 million | Offshore shell company, nominee directors |

| Kamel Djoudi | Palm Jumeirah, Business Bay | $10-15 million | Offshore shell companies, nominee directors |

| Ahmed Hasan Abdul Qaher al-Sheebani | Palm Jumeirah, Dubai Marina, Downtown Dubai | $15-20 million | Offshore shell companies, nominee directors |

| President Abdelmadjid Tebboune’s Entourage | Burj Khalifa, Palm Jumeirah, Downtown Dubai | $620 million (aggregate) | Offshore shell companies, nominee directors |